Sustaining Wealth: The Shift Towards ESG Investments in Family Offices

Introduction

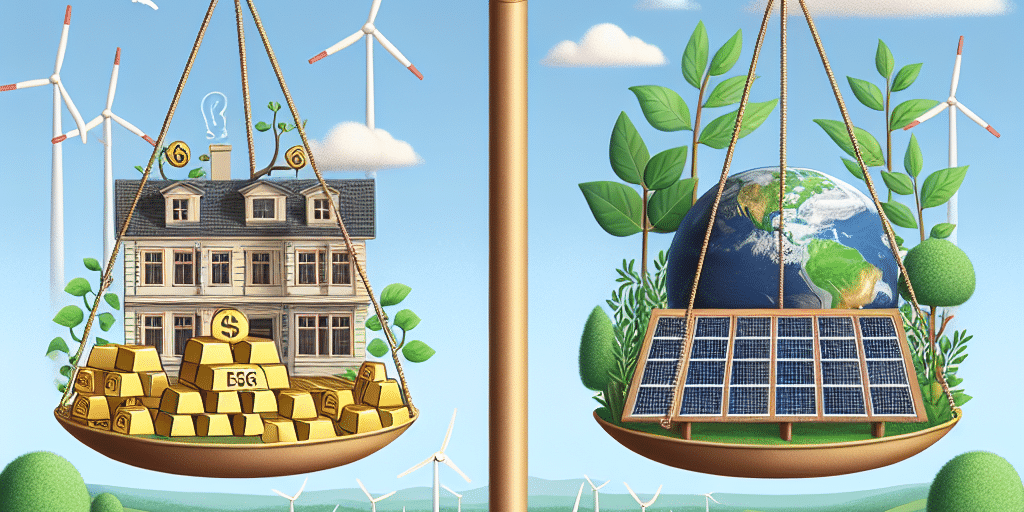

In recent years, the world of investment has been undergoing a significant transformation, particularly among family offices—private wealth management advisory firms that serve ultra-high-net-worth individuals and families. These entities, which often manage substantial assets, are increasingly recognizing the importance of integrating Environmental, Social, and Governance (ESG) considerations into their investment strategies. This shift not only reflects changing societal values but also highlights a broader understanding of sustainable wealth creation that extends beyond mere financial returns.

Understanding ESG Investing

ESG investing refers to the practice of incorporating environmental sustainability, social responsibility, and ethical governance into investment decisions. Investors globally are becoming more aware of the impact their investments have on the planet and society. This growing consciousness is prompting family offices to consider ESG factors as a critical lens through which to evaluate potential investments, thus seeking to align their portfolios with their values.

The Case for ESG in Family Offices

-

Legacy Preservation: Family offices are often established to preserve wealth across generations. By focusing on sustainable investments, these entities can ensure that the wealth they manage is not only financially secure but also aligned with social and environmental stewardship. Investments that consider ESG factors tend to be more resilient against market volatility and evolving regulatory landscapes.

-

Generational Values: As younger generations inherit wealth, they bring with them different priorities and expectations. Millennials and Gen Z investors are particularly vocal about their desire for impact-driven investment strategies. For family offices, addressing these generational shifts is crucial for retaining engagement and ensuring that family legacies endure. Integrating ESG principles can help bridge the gap between generations by aligning investment strategies with their values.

-

Financial Performance: A growing body of research suggests that ESG investments can lead to superior long-term financial performance. More than ever, investors are recognizing that companies with strong ESG practices are better positioned to manage risks and seize opportunities, resulting in sustainable profitability. Family offices that adopt ESG strategies may find themselves not only fulfilling their ethical obligations but also enhancing their financial returns.

- Risk Management: ESG investing allows family offices to mitigate risk associated with environmental disasters, regulatory changes, and social dissent. Companies that fail to prioritize sustainability and governance are increasingly exposed to reputational and operational risks. By investing in firms with robust ESG policies, family offices can protect themselves from unforeseen downturns and controversies.

Implementing an ESG Strategy

Transitioning to an ESG-focused investment strategy requires careful planning and execution. Family offices should take the following steps:

-

Assessment: Begin with a holistic review of existing investment portfolios, evaluating the ESG performance of current assets and identifying areas for alignment with sustainable practices.

-

Education and Training: Family members and investment teams must be educated on ESG principles and their implications. This can involve bringing in external experts or attending workshops and conferences.

-

Define Goals: Establish clear investment objectives related to ESG. This might include specific themes such as renewable energy, gender diversity, or corporate governance.

-

Partnerships: Collaborate with ESG-focused asset managers and advisors who can provide expertise and access to sustainable investment opportunities, as well as track record reporting.

- Accountability and Reporting: Implement systems for measuring and reporting on the ESG performance of investments. Transparency is essential to demonstrate commitment and progress to stakeholders.

The Future Outlook

As global challenges such as climate change and social inequality continue to escalate, the demand for responsible investing will only grow. Family offices are in a prime position to lead this charge. Organizations like the Global Impact Investing Network (GIIN) and the Principles for Responsible Investment (PRI) are laying the groundwork for best practices in ESG investing, which family offices can adopt.

The trend toward ESG investments in family offices is not merely a passing fad; it’s a fundamental shift towards sustainable wealth management that can deliver both impact and returns. As the investment landscape evolves, those family offices that embrace this change will not only safeguard their wealth but also contribute positively to the world, setting a powerful example for future generations.

Conclusion

In conclusion, the shift toward ESG investments represents a pivotal moment for family offices. By recognizing the critical importance of sustainable and responsible investing, these entities are well-positioned to cultivate a legacy that endures for generations. The integration of ESG principles into investment strategies not only aligns financial goals with ethical values but also ensures that the wealth they manage has a positive impact on society and the environment. As the landscape of wealth management continues to evolve, family offices must adapt to sustain their wealth in a way that reflects their values and responsibilities.