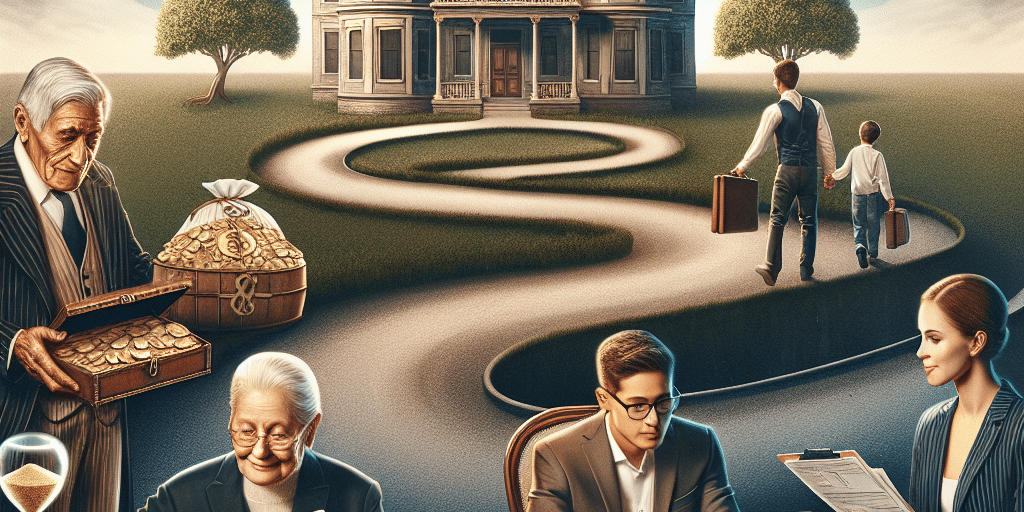

Wealth management is an intricate task, made more complex by one essential factor: family dynamics. The transfer of wealth across generations—often referred to as “intergenerational wealth transfer”—is a common goal for many affluent families. However, the reality is fraught with hurdles that can impact both the financial well-being of descendants and family relationships. Understanding these challenges is essential for ensuring that family fortunes not only endure but flourish over time.

The Challenges of Intergenerational Wealth Management

1. Communication Gaps

One of the most significant hurdles to successful wealth transfer is a lack of communication among family members. Often, families avoid discussions about wealth, fearing that it may lead to conflict or create feelings of entitlement among heirs. However, this silence can lead to misunderstandings and assumptions that can jeopardize the management and preservation of wealth.

To counter this, families should engage in open dialogue about financial goals, expectations, and responsibilities. Regular family meetings can help create a culture of transparency and shared understanding, allowing for candid discussions about wealth management and family values.

2. Changing Values and Priorities

As societal values shift, so do attitudes toward wealth. Younger generations may prioritize social responsibility, sustainability, and entrepreneurial ventures over traditional wealth accumulation. What may have been considered prudent financial management by past generations may now be viewed as conservative or even contrary to modern ideals.

To align family wealth with evolving values, families should consider crafting a shared family mission statement that reflects collective goals and aspirations. This not only unifies family members but can also guide investment decisions and philanthropic efforts that resonate with the family’s identity.

3. Skills and Financial Literacy

Financial illiteracy is a pervasive issue that can stymie the effective management of inherited wealth. Each generation has unique financial challenges, and without proper education and guidance, heirs may find themselves overwhelmed or ill-equipped to handle significant financial responsibility.

Investing in financial education is crucial. Families can provide heirs with the resources they need to understand wealth management, whether through formal education, mentorship from trusted advisors, or practical experience managing smaller investments. This investment in knowledge can empower the next generation to make informed decisions that benefit both themselves and the family wealth.

4. Family Dynamics and Conflict

Family dynamics are inherently complex, and wealth can exacerbate existing rifts or create new ones. Sibling rivalry, favoritism, and differing aspirations can lead to conflicts that undermine family unity and business interests. Inheritance disagreements can escalate quickly, leading to lasting resentment and even legal disputes.

Implementing strategies for conflict resolution is essential. Family governance structures, such as family councils or advisory boards, can help mediate disputes and foster cooperation in decision-making. Additionally, professional facilitators or family business advisors can assist in navigating tough conversations and building consensus.

5. Tax Implications and Financial Structures

Wealth accumulation often comes hand in hand with intricate tax considerations. Navigating these legalities can be daunting, especially as tax laws change over time. Families must also consider the implications of different financial structures, be they trusts, partnerships, or other vehicles for wealth transfer.

Regular consultations with tax professionals and estate planners are vital for families to stay ahead of changes in regulations. Crafting a well-thought-out estate plan not only optimizes tax liability but also clarifies the wishes of the wealth creators, reducing potential disputes.

Moving Forward: Strategies for Success

While the hurdles of managing wealth across generations can be daunting, families can adopt several proactive strategies to enhance their chances of success:

Build a Culture of Communication: Encourage open discussions about money, values, and aspirations. Establish regular family meetings to foster transparency.

Invest in Education: Equip future generations with the financial literacy and skills necessary for responsible wealth management. Consider mentorship and real-life investment opportunities.

Create Governance Structures: Implement family councils or advisory boards to help address conflicts, foster teamwork, and make collective decisions about the family’s wealth.

Align Wealth with Values: Engage in conversations about shared values and develop a family mission statement. Use this as a guiding framework for investment and philanthropic activities.

- Seek Professional Guidance: Regularly consult with financial, legal, and tax professionals to ensure that wealth management strategies are robust and compliant with changing laws.

Conclusion

Managing family wealth across generations is not just about preserving financial assets; it also involves nurturing relationships, values, and legacies. By understanding the challenges and implementing thoughtful strategies, families can create a legacy that not only survives the test of time but also enriches the lives of future generations. Ultimately, the key to successful intergenerational wealth management lies in balancing fiscal responsibility with a shared commitment to family unity and growth.