In an era where technology is reshaping industries across the globe, family offices—wealth management advisory firms that serve high-net-worth individuals and families—are also undergoing a significant transformation. This shift is not merely about adopting the latest tools; it involves a strategic approach to intertwining rich traditions of wealth management with the innovations of digital technology. Successful family offices are now leveraging digital transformation to enhance their operations, improve client relationships, and secure their long-term sustainability.

The Traditional Landscape of Family Offices

Family offices have long been rooted in tradition. These entities often operate under a philosophy of personal relationships, discretion, and bespoke financial guidance. Traditionally, family offices have relied heavily on face-to-face interactions, manual record-keeping, and bespoke investment strategies tailored to individual family needs. The emphasis has been on trust, legacy, and stewardship. However, this classic approach has been tested by the growing complexity of the global market, an influx of data, and the demands of a younger generation with a different set of expectations.

The Need for Digital Transformation

The rationale for digital transformation in family offices has never been more pressing. With the influx of new technologies and the digitization of financial markets, the landscape is evolving. Here are several factors prompting family offices to embrace digital change:

Data Proliferation: The sheer volume of financial data available today is staggering. Family offices can leverage big data analytics to provide tailored investment strategies, risk assessments, and performance evaluations.

Client Expectations: Today’s high-net-worth individuals, especially younger generations, demand more transparency, faster communication, and user-friendly digital interfaces. Technology can enhance client engagement through streamlined services and clearer reporting.

Operational Efficiency: Digital tools can automate repetitive tasks, reducing administrative burdens and allowing family office staff to focus on more strategic initiatives.

Risk Management: The global financial landscape is riddled with risks, from cybersecurity threats to market volatility. Implementing digital solutions can improve risk assessment and management, leading to more informed decision-making.

- Sustainability and ESG Factors: There is a growing emphasis on sustainable investing and the incorporation of environmental, social, and governance (ESG) factors in investment decisions. Digital tools can help family offices track and align their portfolios with such principles.

Strategies for Successful Digital Transformation

For family offices looking to embark on or enhance their digital transformation journey, several strategies can be beneficial:

Assessment of Current Capabilities: Understanding where the office currently stands in terms of digital maturity is crucial. This includes reviewing existing technologies, workflows, and team capabilities.

Defining Clear Objectives: Establishing specific, measurable goals for digital transformation can guide the process. These goals may include improving client satisfaction, increasing operational efficiency, or enhancing risk management.

Investing in Technology: Family offices should identify and invest in the right technology solutions that align with their objectives. This may include portfolio management software, client relationship management (CRM) tools, and cybersecurity measures.

Fostering a Culture of Innovation: Encouraging team members to embrace new technologies and processes is vital. Training and professional development can empower staff to leverage digital tools effectively.

Prioritizing Data Security: As family offices handle significant wealth and sensitive information, robust cybersecurity measures should be a top priority. Implementing secure data management practices will protect client information and foster trust.

- Collaborating with Experts: Engaging with technology consultants or firms that specialize in financial technology can provide valuable insights and facilitate a smoother transition to digital solutions.

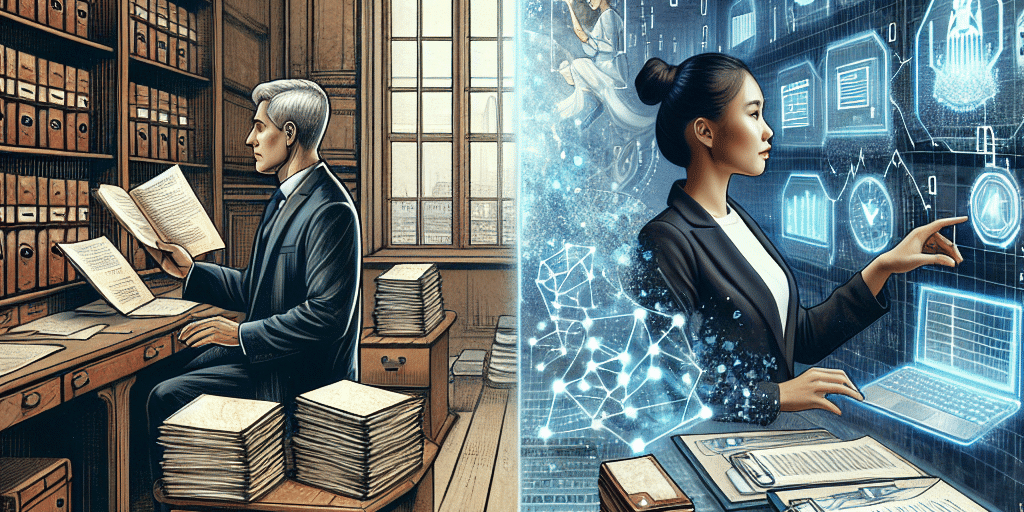

The Hybrid Future: Tradition Meets Technology

The successful digital transformation of family offices does not mean abandoning traditional values. Instead, it is about finding a balance where technology enhances relationships and operational efficiency while honoring the time-tested principles of trust and discretion. By leveraging technology to streamline processes and engage clients more effectively, family offices can secure their relevance and influence in an ever-evolving financial landscape.

As we move forward, family offices that embrace digital transformation while remaining true to their core values will not only survive but thrive. They will continue to provide bespoke solutions that meet the needs of contemporary clients, ensuring that both tradition and technology coexist harmoniously in the management of family wealth. This hybrid approach could very well define the future of family office management, where legacy and innovation come together to create lasting impact.