Rare Finds: The Growing Trend of Collectibles in Wealth Management for Family Offices

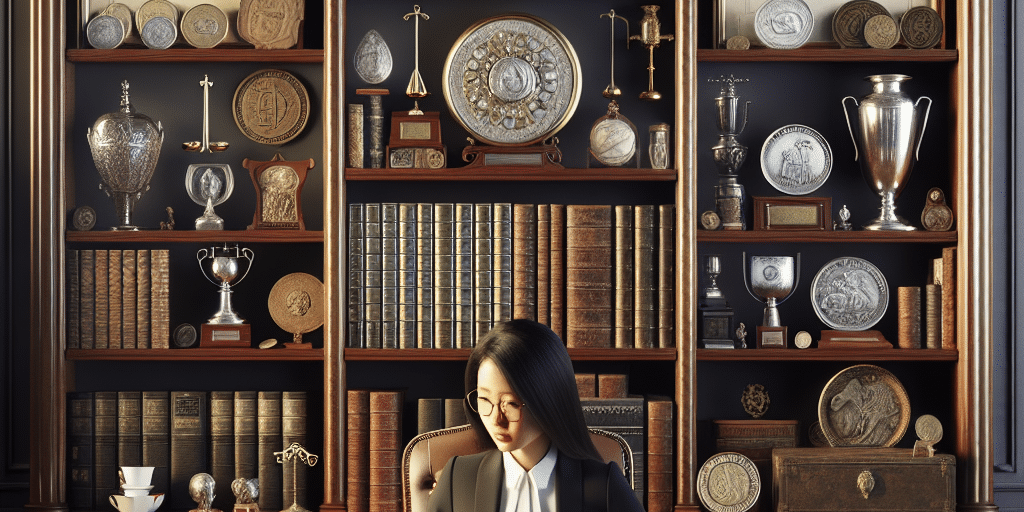

In the ever-evolving landscape of wealth management, family offices are redefining their investment strategies, increasingly turning to alternative assets as a means to preserve and grow wealth. Among these alternatives, collectibles — ranging from rare art and vintage cars to fine wines and classic watches — are gaining prominence as viable investment options. This article explores the rising trend of collectibles in wealth management and offers insights into why family offices are embracing these tangible assets.

The Allure of Collectibles

Collectibles are not just about passion or prestige; they represent a unique intersection of artistry, history, and potential financial return. For many, the emotional connection to these items enhances their value, transforming a simple investment into a personal journey. Family offices, tasked with preserving and growing wealth across generations, are recognizing that collectibles can offer both financial and sentimental benefits.

-

Diversification of Investment Portfolio:

Collectibles provide an excellent way to diversify portfolios, reducing risk associated with traditional assets like stocks and bonds. Economic downturns often affect different asset classes differently; thus, collectibles can act as a hedge against market volatility. By introducing these tangible assets into their portfolios, family offices can balance the risks associated with more conventional investment vehicles. -

Strong Historical Returns:

Many collectibles have demonstrated robust historical returns, sometimes outpacing traditional investments. For example, classic cars, rare coins, and fine art have shown substantial appreciation over the years. These assets tend to be less correlated with stock market performance, making them an attractive option for family offices seeking stable long-term growth. - Tangible Value:

Unlike stocks, which are subject to market whims, collectibles possess intrinsic, tangible value. This quality appeals to family offices focused on legacy, allowing them to hold and showcase items that can be enjoyed by future generations. The ability to interact physically with their assets instills a sense of assurance that is often lacking in ephemeral financial instruments.

The Collector’s Perspective: Emotional and Financial Returns

For family offices, acquiring collectibles isn’t solely a financial endeavor; it often involves a genuine passion for the items themselves. Wealth managers increasingly recognize the dual nature of collectibles as both a store of value and a source of personal fulfillment. This is particularly salient for high-net-worth families, where personal tastes and interests play significant roles in investment decisions.

Take art collecting, for instance. Beyond the financial returns, art provides aesthetic enjoyment and serves as a medium for cultural expression. Family offices involved in art investment often engage in a two-pronged approach, focusing on both financial performance and personal appreciation. This keen interplay between sentiment and strategy enriches the investment experience and encourages meaningful family discussions about wealth, value, and heritage.

Challenges and Considerations

Despite the benefits of collectibles, investing in them comes with unique challenges that family offices must navigate. The subjective nature of value in collectibles can lead to significant price variability, making informed and educated purchasing decisions critical. Additionally, the market for collectibles can be illiquid, posing challenges in the event of a quick sale.

Moreover, authenticity and provenance are crucial in the collectibles arena, where counterfeit items can severely diminish value. Family offices must develop a strong understanding of their chosen collectibles market or work with experts who can guide their decisions. Advisory firms that specialize in collectible investments can offer research, insights, and risk assessment, enabling family offices to make informed choices.

The Future of Collectibles in Wealth Management

As the trend toward alternative investments continues to grow, the appeal of collectibles is likely to expand further. With advancements in technology, online platforms are making it easier for family offices to access and trade collectibles. Auction houses, investment platforms, and marketplaces are incorporating digital solutions that provide transparency, access, and liquidity — making it simpler for family offices to navigate this unique landscape.

Moreover, the growing interest in social and environmental responsibility may influence the types of collectibles that families choose to invest in. Sustainable and ethically sourced items could become increasingly appealing, aligning investments with personal values while promoting responsible stewardship of assets.

Conclusion

The emergence of collectibles as a focal point in wealth management underscores a broader trend towards alternative investments in family offices. By integrating these tangible assets into their portfolios, families can achieve diversification, long-term returns, and emotional satisfaction. As this market continues to mature and evolve, so too will the strategies employed by family offices, crafting a blend of tradition and innovation that engages both their legacy and financial goals for the future. As the saying goes, “Not all that glitters is gold,” but for the discerning collector, many rare finds certainly will.