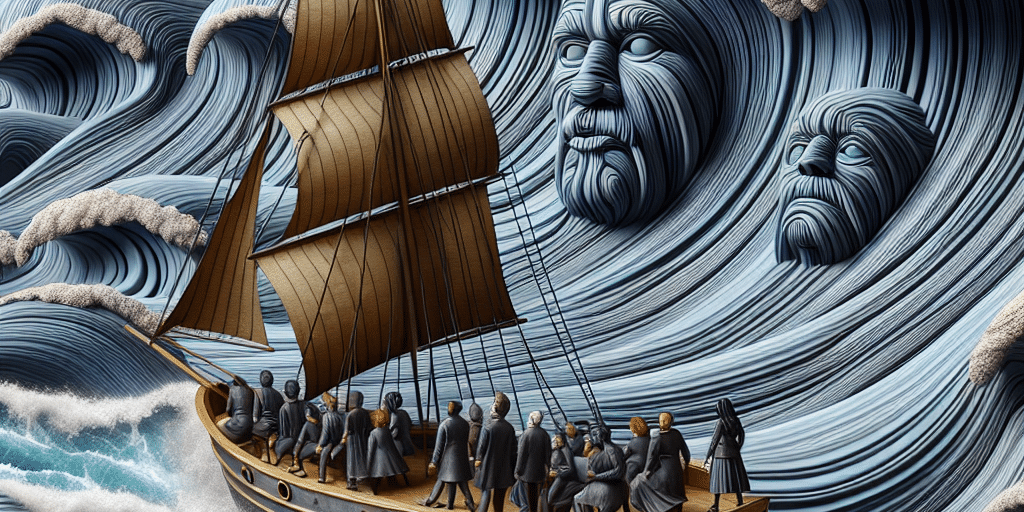

Navigating Turbulent Waters: How Inflation and Market Volatility Shape Family Office Investment Strategies

In an era marked by economic unpredictability, family offices are compelled to recalibrate their investment strategies to safeguard and grow wealth. The confluence of inflationary pressures and heightened market volatility presents unique challenges and opportunities that require nuanced approaches to asset management. Understanding these dynamics is essential for family offices seeking to navigate turbulent waters effectively.

The Current Economic Landscape

As of late 2023, global economies continue to grapple with inflation—driven by supply chain disruptions, rising commodity prices, and central bank policies that have transformed the monetary landscape. The concurrent rise in market volatility, fueled by geopolitical tensions, fluctuating interest rates, and technological disruptions, has created a complex environment for investment decision-making.

Family offices—private wealth management advisory firms that serve ultra-high-net-worth individuals and families—are not exempt from these challenges. Their mission is not only to preserve wealth but also to enhance it over generations. Accordingly, they must adopt flexible and proactive investment strategies, blending traditional and alternative approaches to stay afloat amidst the turbulence.

Adapting Investment Strategies

- Diversification Beyond Traditional Assets

In times of high inflation, traditional asset classes, such as stocks and bonds, may not provide the desired returns. Family offices are increasingly looking to diversify their portfolios with real assets, such as real estate, commodities, and infrastructure. These investments typically maintain value and even appreciate during inflationary periods, offering a hedge against rising prices. For example, real estate can generate rental income that may increase in line with inflation, while commodities, such as gold and oil, often appreciate when consumer prices rise.

- Embracing Alternative Investments

As market volatility ascends, family offices are diversifying their investment strategies into alternative assets. Private equity, venture capital, hedge funds, and even art and collectibles are garnering attention for their potential to deliver returns that are uncorrelated to traditional markets. These assets can serve as both a hedge against volatility and a source of higher potential returns, albeit with increased risk.

Family offices are also focusing on impact investing and environmental, social, and governance (ESG) criteria, as they seek to align their portfolios with their values while potentially generating robust returns. Sustainable investments are becoming mainstream, driven by the recognition that businesses addressing social and environmental challenges may perform better over the long term.

- Utilizing Advanced Risk Management Techniques

The current climate demands an enhanced focus on risk management. Family offices are deploying sophisticated models and analytics to identify and mitigate risks, including inflation risk, market tail risks, and liquidity challenges. Techniques such as derivatives for hedging inflation or using diversified hedging strategies can protect against adverse market movements.

- Active Management and Tactical Allocation

Given the rapid changes in the economic landscape, family offices are gravitating toward active management strategies. Rather than adhering strictly to a buy-and-hold philosophy, they are employing tactical asset allocation to capitalize on short-term market opportunities and macroeconomic trends. This agile approach facilitates timely adjustments to portfolios, allowing family offices to navigate liquidity issues and take advantage of dips in financial markets.

- Long-Term Vision and Patience

While short-term market fluctuations can incite panic, family offices with a long-term focus are better positioned to weather the storm. Having a well-defined investment thesis and understanding the generational nature of their wealth helps family offices resist the urge to divest during downturns. They often take advantage of lower valuations arising from market corrections to invest in quality assets that are expected to appreciate over time.

The Role of Advisors and Technology

Family offices are increasingly turning to external advisors and technology platforms that offer insights into market trends, investment opportunities, and risk management strategies. Utilizing fintech tools for real-time analytics and performance tracking enables better-informed decision-making, enhancing the overall investment process.

Conclusion

As family offices navigate the turbulent waters of inflation and market volatility, their investment strategies must evolve. By diversifying portfolios, embracing alternative investments, employing advanced risk management, and maintaining a long-term perspective, family offices can not only preserve wealth but also position themselves for growth in uncertain times. The key lies in being adaptable, informed, and proactive in an ever-changing economic landscape. In this high-stakes environment, these principles will guide family offices toward securing their financial legacies for generations to come.