In the intricate world of family offices, where wealth management meets the complexities of family dynamics, transparency and trust play crucial roles. A well-structured and clearly communicated reporting system can foster a culture of trust, engagement, and accountability, serving as the backbone of a successful family office. This article explores how to establish a transparent reporting structure that not only enhances family governance but also strengthens relationships among family members and advisors.

Why Transparency Matters

Transparency is not just a buzzword; it is an essential attribute that promotes integrity and confidence within a family office. Family dynamics can often be sensitive, with varying interests, expectations, and goals among family members. A transparent reporting structure:

-

Fosters Trust: Clear visibility into financial and operational matters can help family members feel secure and informed, reducing suspicions or misunderstandings.

-

Encourages Engagement: When family members understand the operations and performance of their wealth, they are more likely to participate in discussions and decision-making processes.

- Strengthens Accountability: With clear reporting lines and defined responsibilities, families can hold themselves and their advisors accountable for outcomes.

Building a Transparent Reporting Structure

1. Define Clear Objectives

Before establishing a reporting structure, it’s essential to identify the specific goals and objectives your family office aims to achieve. Consider the following:

- What key information is necessary for decision-making?

- Are there particular concerns or interests of family members that should be addressed?

- What are the long-term financial goals, and how should reporting reflect these aspirations?

A clear understanding of objectives will guide the design of your reporting structure and ensure it meets the needs of the family.

2. Establish Reporting Frequencies and Formats

Deciding how often to report and in what format is crucial for maintaining transparency. Common reporting frequencies include:

-

Monthly or Quarterly Reports: Provide updates on financial performance, investment strategies, and operational metrics. These reports can take the form of concise dashboards or detailed presentations, depending on the complexity of the information.

-

Annual Reviews: Conduct comprehensive assessments of the overall performance of the family office. This is a good opportunity for deeper discussions regarding long-term strategies.

- Informal Check-Ins: Encourage regular, informal conversations that allow family members to ask questions and voice concerns outside of formal reporting cycles.

3. Use Clear and Accessible Metrics

The metrics you choose to report should be easily understood by all family members, regardless of their financial literacy. Avoid jargon and ensure that data is presented in a straightforward manner. Consider using:

-

Visual Aids: Graphs, charts, and infographics can translate complex data into digestible formats.

- Key Performance Indicators (KPIs): Focus on a few crucial KPIs that align with the family’s objectives and strategic goals, such as net worth growth, portfolio performance, or liquidity ratios.

4. Foster Open Communication

Transparency thrives in an environment of open communication. Create channels for family members to express their thoughts, ask questions, and provide feedback on reports. Some effective methods include:

-

Regular Family Meetings: Schedule consistent gatherings to discuss reports and relevant topics. Encourage participation and celebrate successes together.

- Feedback Mechanisms: Provide family members with ways to give feedback on the reporting structure and content, allowing for continuous improvement.

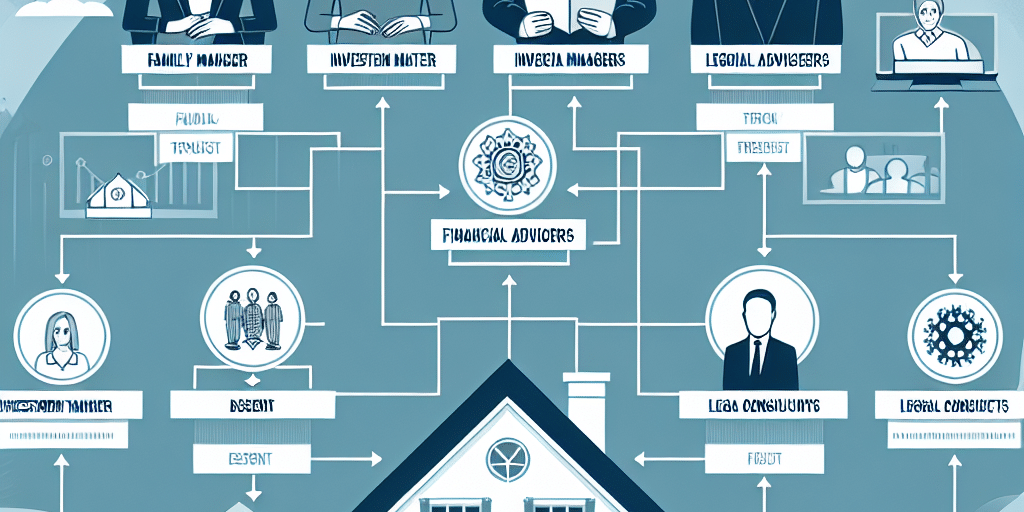

5. Involve Advisors Wisely

Family offices often collaborate with external advisors, from wealth managers to legal professionals. Involving these advisors in the reporting process can enhance credibility and knowledge sharing. Ensure that advisors contribute to the reports by:

-

Providing Expert Insight: Their expertise can help interpret financial data and offer strategic guidance.

- Assisting in Metrics Development: Advisors can help identify relevant KPIs and risk assessments tailored to the family’s needs.

6. Leverage Technology

Utilizing technology can streamline the reporting process, making it easier for family members to access information. Consider employing:

-

Dedicated Family Office Software: These platforms can help in management, tracking, and reporting of various aspects of the family’s wealth, providing a centralized hub for all data.

- Secure Document Sharing: Use cloud-based solutions for sharing important documents while ensuring data privacy and security.

Conclusion

Building a transparent reporting structure in your family office is not merely about numbers; it’s about nurturing trust and fortifying family relationships. By prioritizing clear objectives, establishing consistent reporting protocols, fostering open communication, and leveraging technology, family offices can create an ecosystem where transparency flourishes. In turn, this commitment to transparency will not only help manage wealth effectively but also ensure enduring family unity and collaboration — a legacy that transcends generations.