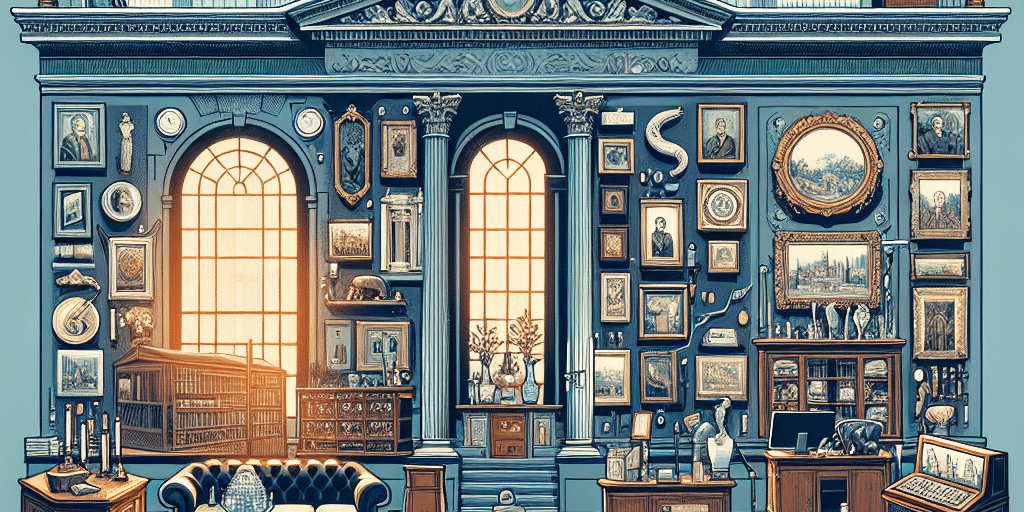

From Art to Antiques: How Family Offices are Embracing Collectibles as Investment Assets

In recent years, the financial landscape has seen a significant shift, with an increasing number of family offices recognizing the value of alternative investments beyond traditional asset classes. One of the most intriguing trends within this movement is the growing interest in collectibles—ranging from fine art and rare antiques to vintage wines and classic cars. As these tangible assets gain traction among affluent investors, it’s crucial to understand why family offices are placing their bets on collectibles and how they are crafting strategies to maximize their value.

The Allure of Collectibles

Collectibles hold a unique position in the investment world. Unlike stocks and bonds, they possess intrinsic value and often tell a story about culture, history, and human creativity. The emotional appeal of collectibles, combined with their potential for appreciation, makes them an attractive option for family offices looking to diversify their portfolios. Here are a few reasons why collectibles are capturing the attention of wealthy families:

Tangible Asset: Collectibles are physical assets that can be appreciated and enjoyed. Unlike digital investments, these items can be displayed, exhibited, and experienced, providing both aesthetic pleasure and financial return.

Hedge Against Inflation: In times of economic uncertainty, collectibles can serve as a hedge against inflation. As currency values fluctuate, the worth of tangible items often remains robust, making them a stable investment choice.

Low Correlation with Traditional Markets: Collectibles typically have a lower correlation with traditional financial markets, providing family offices with an opportunity to mitigate risk and enhance overall portfolio performance.

- Cultural Significance: Investing in art and antiques allows family offices to connect with culture and history. Many collectors see themselves as curators, preserving valuable pieces for future generations while also contributing to cultural preservation.

The Growing Market for Collectibles

The market for collectibles has flourished in recent years, buoyed by technological advancements that facilitate buying and selling. Online auctions, marketplaces, and platforms dedicated to collectibles have made it easier than ever for investors to acquire and manage their collections. Notable sales figures have drawn global attention, with rare items fetching millions of dollars, showcasing the investment potential inherent in this class of assets.

According to a report from the Knight Frank Luxury Investment Index, collectibles have outperformed traditional investments in certain categories, with art, wine, and classic cars reporting staggering returns over the past decade. This performance has encouraged family offices to incorporate collectibles into their investment strategies, thereby diversifying their holdings and seeking potential high yields.

Strategies for Investment

Investing in collectibles requires a nuanced approach, as it involves both financial acumen and a passion for the assets. Family offices have started to implement various strategies to capitalize on this burgeoning interest:

Expert Guidance: Many family offices engage art advisors, curators, and antique specialists to lend their expertise in identifying high-potential investments. This professional insight can help families navigate the complexities of pricing, provenance, and market trends.

Diverse Collection: A diversified collection that spans various categories—such as modern art, fine wines, vintage watches, and historical memorabilia—can minimize risk and enhance potential returns. Family offices are increasingly considering a mix of assets that appeal to different investment horizons and personal interests.

Condition and Authenticity: When investing in collectibles, condition and authenticity are paramount. Family offices often prioritize items with documented provenance, expert appraisals, and certification to ensure their investments are sound and retain value over time.

- Engagement and Education: Family offices are emphasizing education about collectibles, fostering a culture of engagement among the next generation. This hands-on approach allows younger family members to appreciate the value of their collections, ensuring stewardship and a love for art and history.

The Future of Collectibles in Family Offices

As generational wealth continues to pass from one family to another, the appetite for alternative investments, including collectibles, is likely to grow. Family offices are not only investing for profit but are also keen on maintaining a legacy that reflects their values and passion.

Additionally, technology will continue to reshape the collectibles market. Innovations such as blockchain for provenance tracking and augmented reality for virtual showings promise to transform how assets are bought and sold. As these technologies mature, family offices will have even more opportunities to optimize their investments in collectibles.

Conclusion

The movement toward collectibles as investment assets represents a confluence of financial strategy and personal passion for many family offices. As the economy continues to change, embracing the allure of art, antiques, and other collectibles will enable these families to create portfolios that are not only diversified but also deeply meaningful. By investing in the stories and culture inherent in these assets, family offices are forging a new path in wealth management—one that bridges the gap between financial success and personal fulfillment.