Introduction

As the world undergoes an unprecedented digital revolution, family offices are not immune to its tides. These institutions, traditionally established to manage the financial and personal affairs of wealthy families, are increasingly recognizing the need for digital transformation. In this article, we will explore the significance of adopting digital solutions, the various aspects of transformation, and practical steps for implementing change in family offices.

Understanding Digital Transformation

Digital transformation refers to the process of integrating digital technology into all areas of a business, fundamentally changing how it operates and delivers value to clients. For family offices, this transformation is not just about adopting new technologies—it’s about rethinking their overall strategy, enhancing client experiences, building operational efficiency, and preparing to meet future challenges.

Why Digital Transformation is Essential for Family Offices

1. Enhanced Efficiency

With automated processes and digital tools, family offices can streamline operations, reduce manual errors, and save valuable time. Tasks such as financial reporting, investment monitoring, and compliance can be efficiently managed through advanced software, allowing professionals to focus on strategic decision-making.

2. Improved Decision-Making

Access to real-time data analytics is a game-changer for family offices. By leveraging data analytics tools, they can gain insights into investment performance, risk factors, and market trends. This information allows family offices to make informed decisions that align with their clients’ goals and values.

3. Greater Transparency and Accountability

Digital tools offer enhanced transparency in financial activities. Family offices can provide clients with dashboards that track their wealth management performance, fostering trust and accountability within the family.

4. Adaptation to Changing Client Needs

As younger generations inherit wealth, their expectations regarding service delivery are evolving. Digital-savvy heirs demand personalized communication, 24/7 access to information, and seamless integration across platforms. Family offices must adapt to these changing needs to remain relevant and competitive.

Key Areas of Digital Transformation in Family Offices

1. Financial Technology (FinTech)

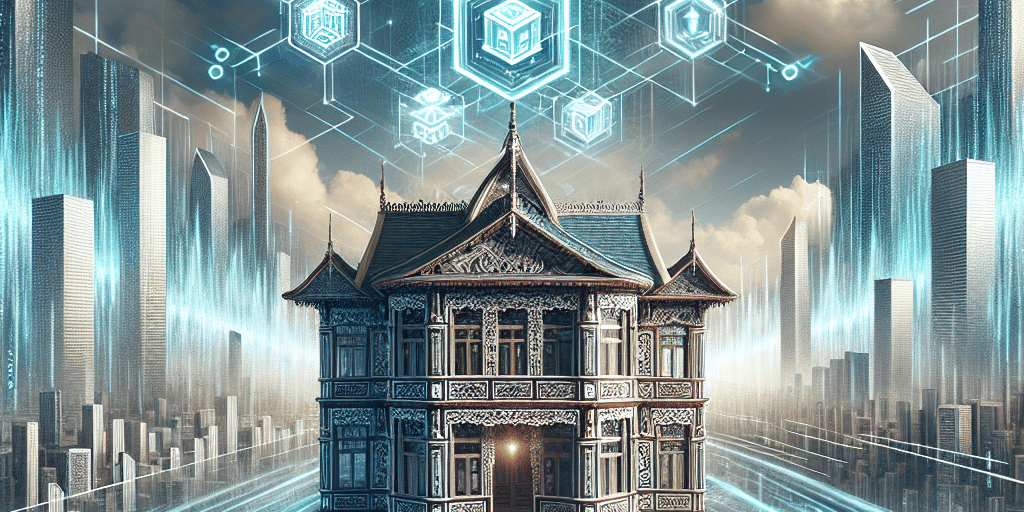

Investing in FinTech solutions can revolutionize how family offices manage their portfolios. From dynamic fintech platforms for wealth management to blockchain technology for secure transactions, adopting innovative financial tools can lead to more productive and strategic investment strategies.

2. Cybersecurity

As family offices handle sensitive and often substantial financial information, cybersecurity must be a top priority during the digital transformation process. Implementing robust security measures, training staff on best practices, and regularly updating security protocols can help protect against ever-evolving cyber threats.

3. Data Management and Analytics

In a world awash with data, family offices need effective data management systems that enable them to collect, analyze, and utilize data. Data analytics can inform investment strategies, assess performance metrics, and even predict market movements.

4. Client Engagement Tools

Family offices should utilize digital marketing and client engagement platforms to foster stronger relationships with their clients. Personalized communication, regular updates, and interactive portals can enhance the client experience, making it easier for family members to access their information and feel connected to the office.

5. Cloud Computing

Moving to cloud-based systems allows family offices to reduce infrastructure costs while providing scalability, flexibility, and collaboration. Cloud solutions enable remote access to essential applications and data, facilitating easier communication and information sharing among team members and clients.

Steps to Implement Digital Transformation

1. Assess Current Capabilities

Before embarking on a digital transformation journey, family offices must evaluate their current technological capabilities, processes, and culture. Understanding what works and identifying areas for improvement is crucial for a successful transition.

2. Define Goals and Objectives

Setting clear objectives for the digital transformation initiative is vital. Whether it’s improving client experience, enhancing cybersecurity, or optimizing operational processes, specific targets should guide the transformation strategy.

3. Engage Stakeholders

Digital transformation is a team effort. Engage all relevant stakeholders—including family members, advisors, and operational staff—in the planning and implementation processes to ensure alignment and buy-in across the board.

4. Invest in Training

Digital tools are only as effective as the personnel utilizing them. Invest in training and upskilling staff to ensure they are well-prepared to leverage new technologies effectively.

5. Collaborate with Experts

Consider partnering with technology consultants or vendors who specialize in family office solutions. Their expertise can provide valuable insights and help customize technologies to meet specific needs.

6. Monitor and Iterate

Digital transformation is not a one-time project but a continuous process. Regularly monitor progress, solicit feedback from stakeholders, and adjust strategies based on results and emerging technologies.

Conclusion

Digital transformation in family offices is no longer an option but a necessity for thriving in an increasingly complex financial landscape. By adopting modern technologies and innovative strategies, family offices can enhance efficiency, improve client relations, and position themselves for future success. Embracing this change opens the door to enhanced performance, deeper engagement, and a sustainable path forward for the generations to come. Navigating the digital transformation journey may be challenging, but the rewards it brings are immeasurable.