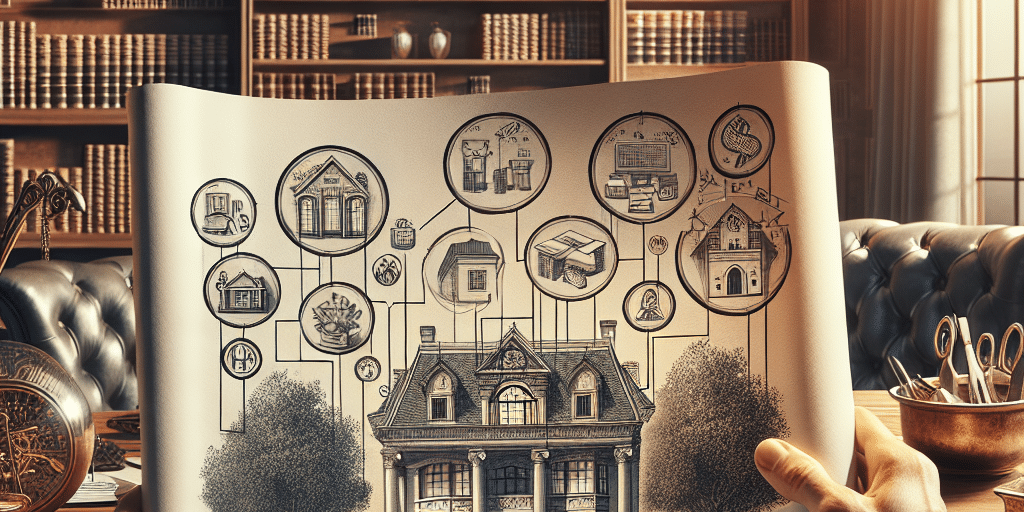

The Blueprint for Success: Defining Roles and Responsibilities in Your Family Office

In the intricate world of family offices, where wealth management, succession planning, and personal values intersect, establishing clear roles and responsibilities is crucial for sustained success. A family office operates not just as a financial vehicle but as a confederation of family aspirations, governance, and legal structures. For many families managing substantial assets, the family office serves as a central hub for investment strategies, philanthropy, and family legacy. However, without a well-defined structure, even the most robust family offices can struggle to achieve their objectives.

This article explores the importance of defining roles and responsibilities within a family office and offers a roadmap for creating an effective organizational framework.

Why Defining Roles and Responsibilities Matters

Enhancing Operational Efficiency: When each member of the family office understands their specific role, tasks can be completed more efficiently. This clarity ensures that everyone is working towards common goals without duplicating efforts or stepping on each other’s toes.

Mitigating Conflicts: Families often bring emotional dynamics into business relationships. Clearly defined roles help stave off potential conflicts by setting boundaries and expectations. It makes it easier to address grievances by referring back to agreed-upon roles rather than interpersonal disputes.

Facilitating Accountability: An organized framework promotes accountability. When roles and responsibilities are clearly delineated, it becomes easier to monitor performance, evaluate progress, and implement necessary adjustments. This transparency fosters trust within the family office.

Encouraging Succession Planning: A well-organized family office is crucial for effective succession planning. Clearly defined roles help ensure that the next generation is prepared to step into their responsibilities, reducing the potential for confusion as leadership transitions.

- Fostering Family Engagement: When family members understand their roles, they are more likely to engage actively in the family office’s operations. This involvement can create a stronger connection to the family’s wealth and legacy, encouraging commitment to shared goals.

Creating the Blueprint for Success

To build an effective framework within your family office, consider the following steps:

Identify Core Functions: Begin by outlining the main functions your family office will serve—investment management, philanthropic initiatives, tax and estate planning, family governance, and education, among others. Each function should correspond with a strategic goal that reflects family values and aspirations.

Assign Roles: Once you have a clear understanding of the core functions, identify individuals responsible for each role. Depending on the size of your family office, roles can be specialized, such as an investment manager or compliance officer, or they can be broader, incorporating oversight responsibilities.

Draft Clear Job Descriptions: Document job descriptions for each role. A detailed description should cover specific responsibilities, required qualifications, and reporting structures. This piece of documentation is essential for onboarding new members and maintaining accountability.

Establish Governance Structures: Develop governance mechanisms such as committees for various functions (investment, philanthropy, etc.). These committees can operate under shared goals but allow for specialization and focused attention on specific areas.

Set Communication Protocols: Design a communication strategy that establishes how information flows within the family office. Regular updates, meetings, and reporting can enhance coordination and allow for collaborative decision-making.

Implement Training Programs: Create educational programs to ensure family members understand the roles, responsibilities, and operations of the family office. This can also prepare them for taking on greater responsibilities as they mature or as circumstances change.

- Continuously Review and Adjust: As markets evolve, family dynamics shift, and new opportunities arise, it’s crucial to review the structure of the family office regularly. Conduct annual assessments to ensure that roles and responsibilities remain aligned with the family’s objectives and the external environment.

Conclusion

The importance of a well-organized family office cannot be overstated. By clearly defining roles and responsibilities, families can enhance operational efficiency, mitigate conflicts, foster accountability, and engage the next generation in meaningful ways. As wealth becomes more complex and family dynamics evolve, the blueprint for success lies in thoughtful planning, transparent communication, and a commitment to shared goals. Investing time and resources into the structure of your family office is an investment into the future legacy of your family.